This is not a ‘get mad at insurance companies’ article, nor is it a ‘venting’ article, it is an explanation in layman's terms of what is happening right now in the auto insurance industry in Alberta. It is intended to help you understand why rates for auto insurance are going up for many of you. I want to give you some ideas and options for things you can do to take control. I'll give you six tips to follow to potentially reduce your auto insurance premiums.

Disclosure... I am an Insurance Advisor. I have sat through many insurance discussions over the past 15 years. I am going to provide a summary of what I have learned from my experience.

What market forces affects auto insurance premiums?

- economic conditions

- reinsurance costs for insurance companies

- competition between companies in the auto insurance market

- cost of regulation

- profitability of each insurance company

- return on equity

- return on investment

- combined operating ratios

So now put yourself in the position of an insurance company. For every $1.00 that the insurance company is collecting in premiums from its customers, it is costing them a $1.20 or more (this will vary from insurer to insurer). They are not being profitable. Insurance companies must study the trends and future outlook to determine how to become profitable, or get out of the auto insurance business.

I know if I owned a store and was selling a product that I was losing money on, I would simply drop that product. But what if I only had a few products? It’s not necessarily an easy decision.

Now I'm not trying to garner sympathy for insurers. I just want you to understand what is happening from the insurance industries perspective.

The top 5 major factors that are hitting the insurers right now which affect their profitability:

1. Bodily injury costs are increasing.

Most insurance companies used to have a small cap for bodily injury of approximately $5,000. The insurance companies try to resolve most injury claims within this level . Now the industry is seeing claims going above and beyond this limit. Lawyers involved in injury claims are increasing the $ value of claims. As an example, previously when there was an accident, an insurance company might reserve about $5,000 per claim for bodily injury. Now they are having to reserve up to $25,000 while the case is getting settled. This is 5 times the potential cost. This is massive!

2. Repair costs for autos is increasing.

The costs to repair vehicles these days are going up dramatically. Years ago, when I got into a small fender bender with my 1989 Chevrolet truck and needed a new front bumper, bracket and some labor, it cost me about $1,000-$1,200. Now, if I was to get into the same fender bender with my new truck, the cost is going to be above $5,000. And what about the other vehicle(s) involved? With the number of luxury vehicles and all the technology incorporated into their design, such as adaptive cruise control sensors, cameras, etc., repair costs are escalating. Let’s not even think about the costs in a autonomous or driver less vehicle.

3. Catastrophic losses and incidents are increasing.

3. Catastrophic losses and incidents are increasing.

A catastrophic loss is an event with 250+ claims or $25 million in potential loss. Each insurance company might have a different definition of a catastrophic loss. Let’s look at the last five catastrophic losses in Canada:

- #5 - Alberta Hailstorm in 2014 ~ over $500 million

- #4 - Slave Lake Fires in 2011 ~ over $700 million

- #3 - Toronto Flood in 2013 ~ over $900 million

- #2 - Alberta Floods in 2013 ~ over $1.5 billion

- #1 - Fort McMurray Wild Fires in 2016 ~ over $3.5 billion

As you can see, there are massive losses just from the top 5 in Canada. It just happens that 4 of those catastrophes were in Alberta, all within the last 8 years.

4. Alberta Government Rate Grid.

In October 2004, the Government of Alberta created a rate grid which all insurance companies must adhere to when pricing the premium for the liability and accident benefit's of auto insurance in Alberta. The premium is dependent on where you live, driving history, and liability limits. Then depending on claims you might move up or down on the grid. Once the grid level has been determined you will receive a surcharge % based on the number of convictions you have. For complete details. you can see the Auto Insurance Grid Rate Calculator

5. Auto Insurance Industry Price Rate Capping.

What is a price rate cap? Insurers must file a rate increase with the Government before it can be implemented, but the government has limited the rate increase per filing term from 5-10%.

Is this rate capping really any good for us as consumers? One would initially think so, but since auto insurance companies can't increase rates as needed, they must look at other alternatives to try to become profitable such as tightening underwriting criteria. Insurance companies might:

- not provide specific coverage's such as section C. If you have a loan on your auto you need to have this section, so you are forced into a facility rate which might be significantly higher in premium.

- not offer payment plans if your credit is sub par or not within there guidelines.

- change the way they do renewals, or will underwrite the policy again with updates.

Making these types of adjustments is completely legal as it is within their rights and the insurance policy provisions, but the insurance companies have never really had to deal with these conditions before.

Each insurance company has an ideal client demographic. It is just getting narrower and narrower. With the rate caps in place, if you are getting a new auto insurance policy, it is technically under priced in today’s terms as far as the insurance companies pricing metrics. The end result is, you as a customer might not be a profitable client next year for the insurance company.

Now what?

Now that we understand what is happening in the industry, even though as consumers we may not like it, our auto insurance premiums are increasing. This isn't about a consumer being a bad client; we just might not be a profitable client.

Here are Six tips to help you take control of your auto insurance premiums.

1. Increase your credit worthiness.

You are probably thinking what the hell does credit have to do with insurance? In short, everything. With all the data being gathered today, insurance companies have realized there is a direct relationship between your credit worthiness (credit score) and claims. Generally, people who have lower credit scores will typically have more insurance claims.

So what do you do?

- First step is to get your credit report. If you aren't sure how to get yours we can help guide you. Click here to let us know.

- Check your score. Once you get your credit report it will give you a number, which is your score. It will also provide a list of debt instruments you have and have had in the past. My recommendation is to get your creditworthiness into the top 80% of credit scores. So, if the top score is 900, at 80% your initial goal should be to get above 720. If you are not sure how to do this and would be interested in sitting in on a webinar or information session, just let us know and we will look at arranging this.

- Stay on top of your credit score. If your score is not the greatest, as you are working on improving it, have a look at your score every six months. If your score is already over 720, work at getting it even higher.

2. Understand your current insurance broker’s renewal process.

This is assuming you have your insurance through an insurance broker and not an insurance agent. Does your insurance broker review your policy each year? or do they just let it automatically renew? Now I am not saying you need to change brokers, but chances are if you have been thinking about this you might be ready to look elsewhere. With my insurance background, I do know what brokers typically do and they all have different procedures depending on if they have the manpower to look at renewals in depth?

Questions you can ask your broker are:

- do you look at the renewal to ensure coverage is adequate?

- do you contact customers if there are changes with the insurance companies that affect their policy? Or, how do you let your customers know?

- do you check if there have been any claims or tickets dropping off that might reduce premiums?

- do you have a price increase set so that if the renewal comes in over this amount you will do a insurance company market check for me?

All insurance brokers operate differently, but definitely some questions you might want to ask.

3. Increase Deductibles.

Insurance companies know that if you have higher deductibles there will be fewer small claims. They want each customer to take personal responsibility and self insure for smaller claims. Insurance is really in place for major claims, so don't abuse it for smaller stuff.

4. Don’t Speed.

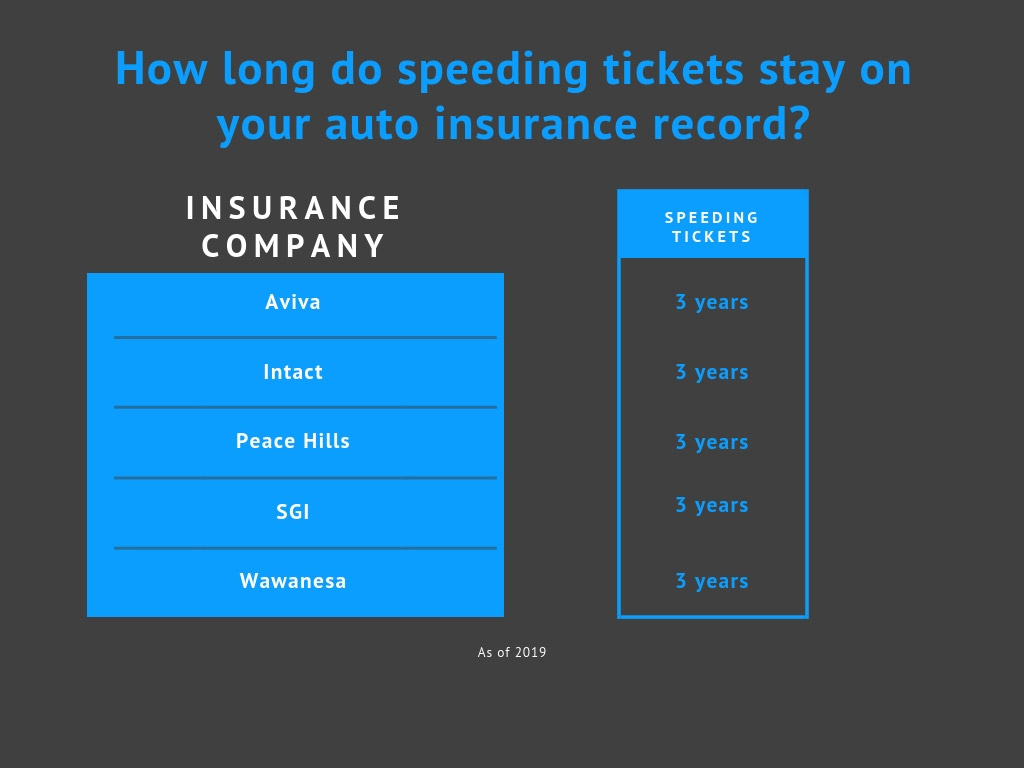

Do you have any speeding tickets or claims that will be dropping off that could potentially reduce your premium? Typically if you have a speeding ticket, they affect your premium but will fall off after 3 years. If you do have some speeding tickets know your dates and set a reminder for you to contact your insurance broker just before that third year anniversary is coming up and ask them to check to see if this will reduce your premiums. Just as each insurance company is different, so are we as consumers.

For claims, they do vary depending on the insurance company. Make sure you check with each specific company to be sure.

5. Bundle Your Home and Auto Insurance Policies.

Ask your broker to give you pricing comparisons showing if you bundle your policies together with the same insurance company and separate as well. Typically it made sense to bundle as you would get additional discounts, but now with auto insurance rates on the rise, the extra benefits and costs savings from bundling might not be worth it anymore. Make sure you are not sacrificing proper coverage just to save a few dollars either.

Once you see the comparisons you will be able to make an educated decision. Your broker should be able to give you a great explanation, along with options. Is this a lot of work for the insurance broker? Yes. In any event make sure your insurance policies, whether separate or together, are with the same insurance broker so you only need to make one call when dealing with any of your policies.

6. Shop around for a broker you are comfortable working with.

I recommend working with a broker who has at least five different insurance company markets. Why five? Each insurance company operates differently. They all operate on different scales and volumes of business. They are in different areas of Canada. They have different claims and loss ratios, etc.. With access to five companies, there will typically be one or two with significantly lower premiums. I have found that if a broker only has three insurance company markets or less it doesn't often work. In our business we found that five was sufficient and with five it is reasonable to expect that the brokers can fully understand each companies products. Sometimes a broker might have 10 or more insurance company markets. This can be an issue. How can a customer service representative know all insurance companies products that well to provide good advice?

You want to feel comfortable with the customer service representative, the insurance brokerage, and the process's they have in place.

I hope this information will help you take control of your auto insurance affairs and leave you feeling confident that you know what to do. Trust me, once you start asking a few more questions and take some time to understand you will indeed have great success. If you aren't sure what broker to utilize, we would be glad to help provide an option.

Feel free to share this article with others you care about. Sharing is caring!

Sources: 2018 Facts of the Property and Casualty Insurance Industry in Canada - Insurance Bureau of Canada, Alberta Automobile Insurance Rate Board